If you’ve ever priced a product at $37.49 instead of rounding up to $40, you’ve likely used cost-plus pricing—whether intentionally or not. It’s a go-to method for brands and sellers who want a straightforward way to ensure profitability: calculate your costs, add a fixed markup and you’re done.

One of the most widely used pricing strategies in retail, manufacturing and services, cost-plus pricing appeals because of its simplicity and perceived fairness. You know your costs, set your profit margin, and avoid overcomplicating your pricing model.

But its simplicity can be deceptive. While easy to implement, cost-plus pricing also carries risks—especially in competitive markets where value perception, price elasticity and customer willingness to pay matter just as much as your cost base.

In this post, we’ll break down the cost-plus pricing formula, look at real-world examples, and discuss when this strategy makes sense and when it doesn’t. You’ll learn how to apply it effectively and whether it truly aligns with your business goals or if it’s time to explore smarter alternatives.

What Is Cost-Plus Pricing? Definition, Purpose & Examples

Cost-plus pricing is a straightforward method where you determine your selling price by adding a fixed markup to your total production cost. That includes both direct and indirect costs—like materials, labor, overhead and admin expenses—plus a predetermined profit margin.

Unlike other pricing strategies that respond to the market, cost-plus pricing is entirely inward-looking. You base the price on your internal cost structure, not on customer perception or competitor actions.

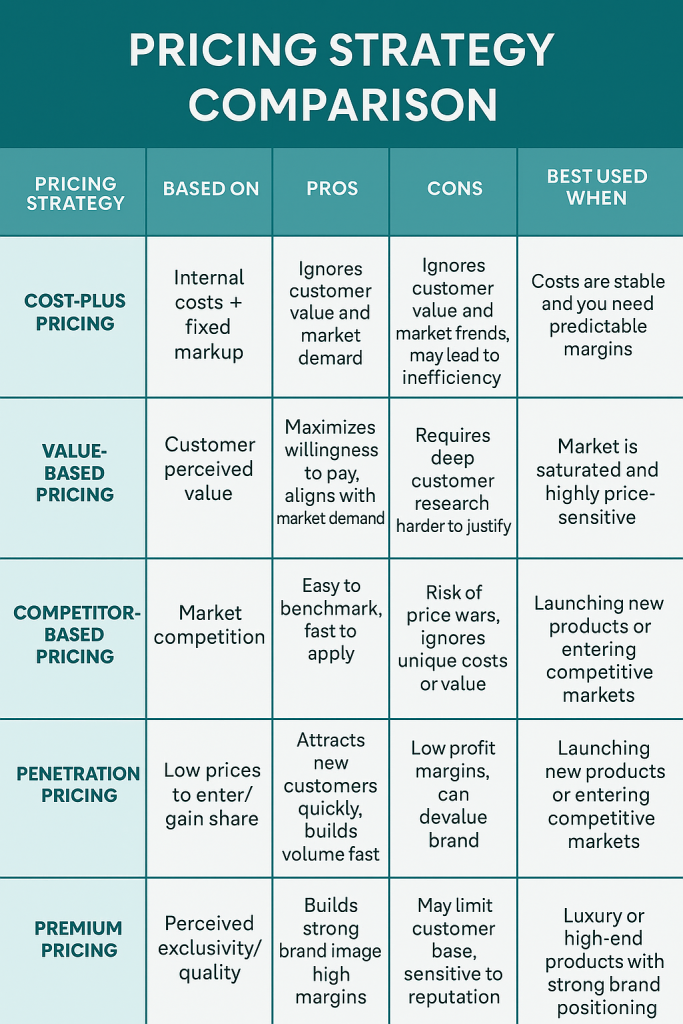

Let’s compare it to other common pricing strategies:

- Value-based pricing: Focuses on what customers are willing to pay based on perceived value

- Competitor pricing: Aligns pricing with rival offerings in your market

- Penetration pricing: Sets low entry prices to capture market share quickly

- Premium pricing: Positions products at a high price to signal superior quality or exclusivity

Many businesses adopt the cost-plus method of pricing because it is clear and simple. You don’t need deep customer insights or expensive research—just accurate cost data and a clear profit goal!

How Cost-Plus Pricing Works: Simple 2-Step Breakdown

The cost-plus approach boils down to two steps:

- Add up all costs

- Direct costs: raw materials, packaging, manufacturing labor

- Indirect costs: rent, utilities, software, salaries, overhead

- Direct costs: raw materials, packaging, manufacturing labor

- Apply your profit margin

- Add your target markup (e.g., 25%) on top of your total cost

Think of it like building a product “from the inside out.” You start with a solid understanding of what it costs to produce, then layer your profit margin on top to arrive at a final selling price.

Cost-Plus Pricing Formula: How to Calculate Selling Price

At its core, the cost-plus pricing formula is simple: add your total costs, then tack on a markup percentage to ensure profit.

Here’s the formula:

Selling Price = Total Cost × (1 + Markup Percentage)

Where Total Cost includes both direct and indirect costs, and the Markup Percentage is your desired profit margin expressed as a decimal (e.g., 25% = 0.25).

Cost-Plus Pricing Calculator

Enter your total cost and desired profit margin to calculate your selling price.

???? Cost-Plus Pricing Calculator

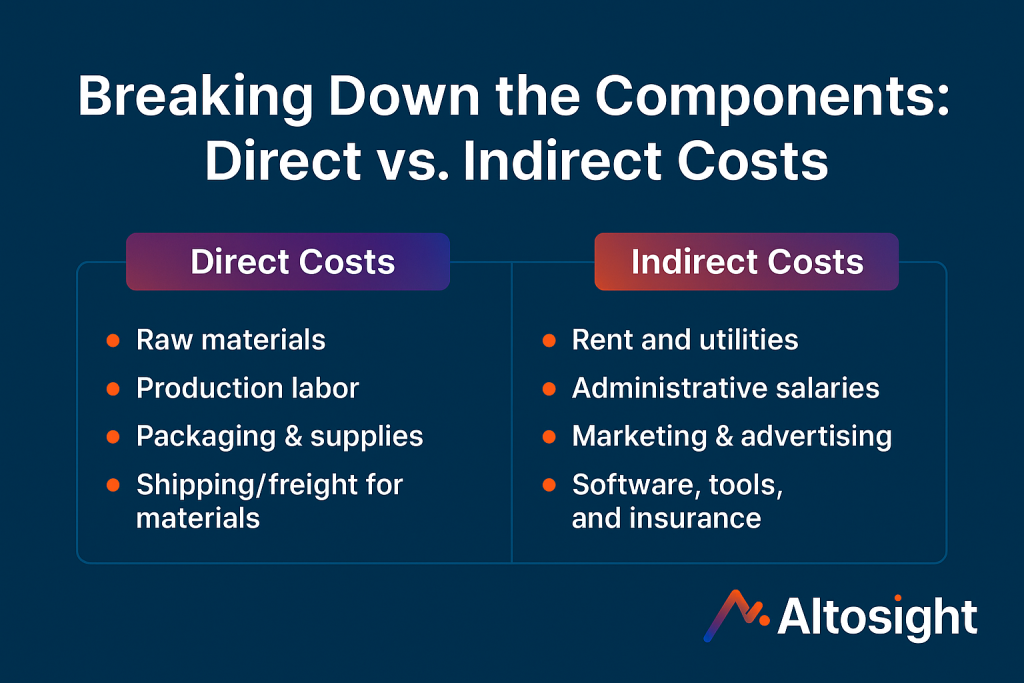

Breaking Down the Components: Direct vs Indirect Costs

To apply cost-plus pricing correctly, you need to fully account for all the expenses that go into making your product or delivering your service. These typically fall into two categories:

Direct Costs (Cost of Goods Sold / COGS)

These are costs directly tied to production:

- Raw materials

- Production labor

- Packaging and manufacturing supplies

- Shipping or freight for materials

Indirect Costs (Overhead)

These are the broader expenses that support your operations:

- Rent and utilities

- Administrative salaries

- Marketing and advertising

- Software, tools, and insurance

- Equipment depreciation

Accurately capturing both types of costs ensures your pricing covers all business expenses—not just the obvious ones.

How to Set the Right Markup in Cost-Plus Pricing

Once you’ve nailed down your total cost, the next step is deciding on your markup. This is the “plus” in cost-plus pricing and it can vary widely depending on your industry, competition, and business goals.

???? Did You Know?

- Grocery stores typically apply 15–25% markups

- Jewelry retailers often use markups of 100% or more

- Most industries fall somewhere in the 10–50% range

Your markup should reflect not only your desired profit but also:

- Industry benchmarks

- Competitor pricing

- Customer willingness to pay

What the “Plus” Really Means in Cost-Plus Pricing

A common point of confusion: does the “plus” include any additional hidden costs? The answer is no. The “plus” refers only to your profit margin—not unexpected or missed expenses.

Your total cost figure should already include all direct and indirect costs. The “plus” is the clean, additional margin you aim to earn on top of those costs.

Being disciplined about this distinction helps you price accurately and avoid underestimating your expenses.

Cost-Plus Pricing Example: Simple Formula in Action

Let’s walk through a basic example to see cost-plus pricing in practice.

Suppose you run a small pottery business and want to price a handcrafted ceramic mug. Here’s the breakdown of your costs per unit:

- Materials: $3.00

- Labor: $2.00

- Overhead (rent, utilities, etc.): $3.00

Total cost = $8.00

Now, you apply a 50% markup to cover your desired profit:

Selling Price = $8.00 × (1 + 0.50)

Selling Price = $8.00 × 1.50 = $12.00

So, you’d price each mug at $12.00 to achieve a 50% profit margin over cost.

Real-World Cost-Plus Pricing Examples Across Industries

Cost-plus pricing isn’t just for small businesses, it’s used in industries ranging from retail to aerospace. Here are a few real-world scenarios:

???? Construction & Contracting

Contractors often use cost-plus bids when final costs are hard to estimate. For example, a home renovation project may be billed as:

“Materials + 15%”—where the contractor passes along exact costs and adds a fixed margin.

???? Government & Defense Contracts

Major government contracts—especially in defense and infrastructure—are frequently awarded under cost-plus models.

Companies like Boeing or Lockheed Martin may receive reimbursement for actual expenses plus a guaranteed profit margin (e.g., 10–15%).

???? Retail Chains (e.g., Walmart, Target)

Retailers often use simplified cost-plus pricing for everyday products. For instance, Walmart may apply a flat 50% markup on certain product categories, especially private-label goods.

???? Manufacturing & Industrial Equipment

In industrial sectors, manufacturers may adjust cost-plus pricing based on product complexity.

A standard item might carry a 30% markup, while a highly customized machine could be priced at cost + 70%, depending on engineering or design requirements.

Key Advantages of Cost-Based Pricing Methods

Cost-plus pricing remains a popular pricing strategy for good reasons, especially among manufacturers, service providers and retailers who prioritize simplicity and cost recovery.

Here are the key advantages:

1. Simple and Easy to Use

The biggest appeal of cost-plus pricing is its simplicity. You calculate total costs, apply a consistent markup, and arrive at a selling price—no complex market analysis required.

2. Full Cost Coverage

One of the top advantages of cost-based pricing is that it ensures all costs are covered. This eliminates the risk of underpricing, especially in businesses with fluctuating expenses.

???? Which of the following is an advantage of cost-based pricing?

Complete cost recovery is often the most cited benefit.

3. Predictable Profit Margins

Consistent markups allow for reliable revenue forecasting. This makes budgeting, cash flow planning, and financial modeling far more predictable.

4. Justifiable Price Increases

When costs go up, price adjustments are easy to explain. You can tie increases directly to input costs—making it easier to communicate with customers and maintain trust.

5. Less Prone to Price Wars

Since pricing is internally driven (not reactive to competitors), businesses using cost-plus are less likely to undercut each other or spiral into damaging price wars.

Disadvantages of Markup Pricing in Competitive Markets

While cost-plus pricing is convenient, it comes with serious disadvantages, particularly in dynamic or customer-driven markets.

1. Ignores Market Demand and Customer Value

Perhaps the biggest drawback of markup pricing is that it disregards what customers are actually willing to pay. You might price an item at $50 based on your costs, but if customers only see $30 in value, it won’t sell.

2. Encourages Operational Inefficiency

Because the model guarantees a profit margin, businesses may lack the incentive to reduce costs or optimize operations. If you overspend, you simply pass the cost on to the customer.

???? Why is inefficiency a risk in cost-plus pricing?

It shields poor internal cost control by embedding inefficiencies into the price.

3. Leaves You Vulnerable to Value-Based Competitors

Competitors using value-based or dynamic pricing may outmaneuver you by aligning pricing with customer expectations, not just internal math.

4. Misses Premium Pricing Opportunities

A rigid markup approach might cause you to underprice high-demand items that customers would happily pay more for, leaving potential profits on the table.

5. Oversimplifies Product Differences

Applying the same markup across your product line ignores demand elasticity and customer behavior. Not all products should follow the same pricing logic.

Pricing Strategy Comparison Table

How Cost-Plus Pricing Impacts Marketing and Business Strategy

Cost-plus pricing doesn’t just affect the final price of your product, it influences your overall brand positioning, marketing narrative, and strategic decisions.

Businesses using this approach typically emphasize fair pricing, consistency, and transparency. Rather than competing on luxury, innovation, or emotional appeal, their messaging highlights value for money and reliability.

This strategy resonates with cost-conscious buyers who care more about utility and affordability than premium features or status-driven branding.

Why Cost-Based Pricing Appeals to Value-Focused Customers

Customers drawn to cost-plus pricing tend to appreciate honesty and practicality. They’re looking for:

- Clear justification behind prices

- Assurance they’re not overpaying

- Products that meet functional needs without unnecessary frills

Cost-plus brands often market themselves as fair, trustworthy, and no-nonsense, positioning against competitors who inflate prices based on perceived value or branding.

Cost-Plus Accounting: Forecasting, Budgeting & Pricing Clarity

One operational advantage of the cost-plus model is its tight integration with cost accounting. Businesses using it often experience:

- Easier budgeting: Costs are well-defined and directly tied to pricing

- Reliable financial forecasting: Profit margins remain stable

- Streamlined reporting: Pricing decisions are easier to justify internally and externally

This clarity allows founders, CFOs, and sales leaders to make data-driven decisions without extensive guesswork.

???? Pro Tip: Use Tiered Markups to Stay Competitive

Instead of applying a flat markup across all products, consider segmenting by category or demand level. For example:

- High-demand or niche items → 40–60% markup

- Commodities or price-sensitive SKUs → 15–25% markup

This flexible approach keeps you profitable while remaining competitive where it matters most.

Sales teams also benefit: when price increases stem from rising input costs (not arbitrary hikes), they can confidently explain changes, building trust with customers over time.

Strategic Tips for Using Cost-Plus Pricing Effectively

Cost-plus pricing may be simple, but using it strategically can make a major difference in how competitive and profitable your business becomes. Below are several practical tips to help you apply it wisely:

???? 1. Don’t Use a Flat Markup Across All Products

Different products have different price elasticity and perceived value. A one-size-fits-all markup can leave money on the table or price you out of the market.

Strategy:

- Apply higher markups to high-demand, low-competition products

- Use lower markups on commoditized or price-sensitive SKUs

???? 2. Factor in All Hidden and Variable Costs

Many businesses underprice by forgetting to include costs like packaging, storage, payment processing fees, or returns.

Strategy:

Build detailed cost templates per product category to avoid unexpected margin erosion.

???? 3. Train Sales Teams on Cost Justification Messaging

Your pricing should never feel arbitrary to customers, especially during increases.

Strategy:

Give your sales team clear cost-based explanations they can use when customers question pricing. “We adjusted prices due to a 12% increase in raw material costs” builds trust and credibility.

???? 4. Use Cost-Plus Pricing for Forecasting—Not Just Selling

Even if you move toward dynamic or value-based pricing later, cost-plus remains a solid baseline for budgeting and profit planning.

Strategy:

Use it to model margins, break-even points, and product-level profitability in your financial forecasts.

???? 5. Test Higher Markups with A/B or Split Pricing

Just because cost-plus gave you a “safe” price doesn’t mean it’s optimal.

Strategy:

Test different markups on your product pages or ad landing pages. You might find customers are willing to pay 10–20% more for the same item.

???? 6. Blend Cost-Plus with Value-Based Insights as You Scale

As your brand grows and gathers more data, combine cost-plus with value-based pricing signals, like customer feedback, willingness to pay, or competitor gaps.

Strategy:

Let cost-plus guide your minimum price, but adjust upward when your product’s value perception exceeds its base cost.

FAQs About Cost-Plus Pricing: Examples, Use Cases & More

???? What does cost-plus pricing entail?

It involves totaling all direct and indirect production costs, then applying a markup to determine the selling price.

Formula: Selling Price = Total Cost × (1 + Markup Percentage)

???? What is a simple example of cost-plus pricing?

If a bakery spends $2 to bake a loaf of bread and applies a 100% markup, it sells the loaf for $4. Contractors often charge “materials + 30%” in home renovations.

???? Which companies use cost-plus pricing?

- Construction firms and contractors

- Wholesalers and industrial manufacturers

- Retailers like Home Depot or Lowe’s (use standard markups)

- Defense contractors like Raytheon or Lockheed Martin under government cost-plus contracts

???? What’s the difference between cost-based and value-based pricing?

- Cost-based: Focuses on internal expenses and ensures minimum profitability

- Value-based: Prices according to customer-perceived value—often enabling higher margins

???? Is cost-plus pricing good for small businesses?

Yes—especially when starting out. It’s simple, ensures you cover costs, and helps avoid underpricing. Over time, blending in value-based pricing elements can lead to more competitive positioning and improved margins.

Final Thoughts: Should You Use Cost-Plus Pricing?

Cost-plus pricing offers a solid foundation, especially for businesses that need predictable margins, transparent pricing structures, and simplified decision-making.

It’s particularly effective in industries where costs are stable, and customers prioritize fairness and consistency over innovation or luxury.

This strategy works best for:

- Standardized or commoditized products

- Government contracts

- Custom manufacturing or wholesale models

However, cost-plus pricing isn’t without its flaws. It overlooks:

- Customer perception and willingness to pay

- Shifting market dynamics

- Competitor pricing strategies

If you rely on cost-plus pricing alone, you risk leaving money on the table or misaligning with market demand.

The smartest approach? Use cost-plus as a starting point, but evolve your strategy as your business grows. Combine it with value-based pricing insights, competitor data, and product segmentation to optimize margins without sacrificing competitiveness.

???? Pro Tip: Let Real-Time Data Guide Your Pricing Strategy

Need help refining your pricing approach at scale? Altosight helps brands extract and analyze real-time market data—so you can make informed, competitive pricing decisions backed by actual insights, not guesswork.