Profitable businesses don’t guess at pricing; they engineer it. The difference between companies that thrive and those that struggle often comes down to one critical skill: strategic markup pricing that protects profits while staying competitive.

Most businesses price their products by checking what competitors charge, adding a rough percentage to costs, or worse, guessing what feels right.

Forward-thinking companies take a different approach. They utilize systematic markup pricing to ensure profitability while remaining competitive in their market.

Today, we’ll discuss everything from basic markup calculations to advanced dynamic pricing strategies.

We’ll cover the formulas that work, industry-specific benchmarks, and hands-on tools you can use immediately. Plus, you’ll discover the common mistakes that erode profits even when markup percentages look good on paper.

Ready to turn markup pricing from guesswork into a profit-driving system? Let’s start with the fundamentals that every business owner needs to understand.

What Is Markup Pricing and Why Does It Matter?

Markup pricing means adding a specific amount or percentage to your product’s cost to determine the selling price. Think of it as your profit insurance policy—the systematic method that ensures every sale contributes to your business growth rather than just covering expenses.

Here’s how it works in practice. You manufacture a product for $40. You decide on a 50% markup. Your selling price becomes $60 ($40 cost + $20 markup = $60 selling price). That extra $20 covers your overhead, marketing costs, and desired profit margin.

Markup is best defined as an increase in price that helps the seller profit and cover costs beyond direct product expenses.

What does it mean to mark up a price? You’re building in financial protection for your business while creating sustainable pricing that customers accept.

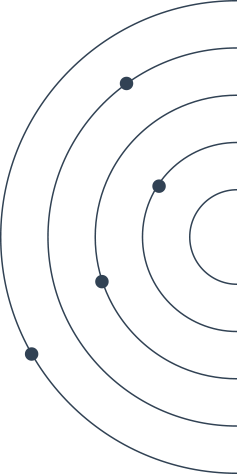

Understanding the markup price’s meaning becomes crucial when you realize how different it is from related concepts. Markup and profit margin aren’t the same thing, though people often confuse them.

Markup calculates the increase based on your cost, while margin calculates profit based on the selling price.

Let’s say you have that same $40 product selling for $60. Your markup is 50% ($20 increase ÷ $40 cost).

Your profit margin is 33.3% ($20 profit ÷ $60 selling price): same numbers, different calculations, completely different strategic implications.

Modern businesses need systematic markup pricing for five critical reasons:

- It guarantees profitability on every transaction instead of hoping things work out.

- It creates pricing consistency across your entire product line, which builds customer trust and simplifies operations.

- Markup pricing scales with your business growth. Whether you’re selling 100 units or 10,000 units, the same markup principles apply.

- It provides a foundation for competitive analysis — you can adjust markup percentages based on market conditions while maintaining profitability standards.

- Markup pricing integrates perfectly with modern e-commerce platforms and pricing software. You can automate markup calculations, test different percentages, and adjust pricing across multiple sales channels simultaneously.

So, what is markup pricing in the modern market? It’s the difference between businesses that thrive in the long term and those that struggle to stay profitable.

Companies using strategic markup pricing report 15-25% higher profit margins than those relying on ad-hoc pricing methods.

However, the mark up meaning in business extends beyond simple math. What is a price markup really accomplishing?

It’s creating a buffer against cost increases, funding future product development, and ensuring your business survives economic downturns. Price markup’s meaning encompasses both immediate profitability and long-term business sustainability.

How To Calculate Markup: A Step-by-Step Guide

Calculating markup correctly requires understanding two fundamental approaches that serve different business strategies. The choice between cost-based and selling-price-based markup affects your profit margins, competitive positioning, and pricing flexibility.

| Markup Method | Formula | Best Used For |

| Cost-Based Markup | Markup % = (Selling Price – Cost) ÷ Cost × 100 | Manufacturing, retail, clear cost structures |

| Selling Price Calculation | Selling Price = Cost × (1 + Markup %) | Standard product pricing |

| Selling-Price-Based Markup | Markup % = (Selling Price – Cost) ÷ Selling Price × 100 | Luxury goods, services, and market-driven pricing |

Most businesses start with cost-based markup because it’s intuitive and directly relates to profit goals. You know your costs, decide how much profit you want, and calculate the selling price accordingly.

The 5-Step Markup Calculation Process

Follow these five steps for accurate markup calculations every time.

➡️ Step 1: Calculate True Product Costs – Include materials, labor, overhead allocation, and hidden expenses like storage or handling fees.

➡️ Step 2: Set Target Markup or Price – Consider industry standards, competitive landscape, and profit goals when determining your markup percentage or desired selling price.

➡️ Step 3: Apply the Right Formula – Use a cost-based markup for both manufacturing and retail, with clear and transparent cost structures. Choose a selling-price-based markup for service industries and luxury goods, where market perception drives pricing.

➡️ Step 4: Verify Against Market Reality – Check your calculated price against competitor pricing and market conditions—mathematically correct doesn’t always mean commercially viable.

➡️ Step 5: Document and Track Performance – Record markup decisions for consistency and monitor actual results versus assumptions to refine future strategies.

Let’s work through a few markup pricing examples that show these calculation methods in action.

Example 1: Physical Product Markup

A manufacturer produces wireless headphones with total costs of $45 per unit. They want a 60% markup using the cost-based method.

Selling Price = $45 × (1 + 0.60) = $45 × 1.60 = $72

Verification: ($72 – $45) ÷ $45 × 100 = 60% markup

Example 2: Service Business Markup

A consulting firm completes a project with $1,200 in direct costs (time, materials, overhead). They target a $2,000 selling price and need to calculate their markup percentage.

Markup Percentage = ($2,000 – $1,200) ÷ $1,200 × 100 = 66.7%

Example 3: E-commerce with Platform Fees

An online retailer sells kitchen gadgets with $25 product costs. Platform fees, shipping, and payment processing add $8 per transaction. They want a 40% markup on total costs.

Total Costs = $25 + $8 = $33

Selling Price = $33 × (1 + 0.40) = $33 × 1.40 = $46.20

Example 4: Volume Pricing Scenario

A wholesale distributor buys products for $15 each but gets volume discounts at higher quantities:

- 1-100 units: $15 each

- 101-500 units: $13.50 each

- 500+ units: $12 each

With 40% markup across all tiers:

- Small orders: $15 × 1.40 = $21

- Medium orders: $13.50 × 1.40 = $18.90

- Large orders: $12 × 1.40 = $16.80

These markup examples illustrate how the same percentage yields different profit dollars, depending on cost structures and volume considerations.

The key is consistently applying your chosen markup strategy while remaining flexible enough to respond to market conditions.

Professional markup calculations account for all cost variables, use appropriate formulas for your business model, and include verification against competitive realities.

Master these fundamentals, and you’ll have the foundation for any advanced markup pricing strategy.

Markup Strategies for Different Business Models

Your business model determines which markup strategy will drive the best results. Standard markup pricing entails applying consistent percentages across product lines, but smart businesses know when to break the rules.

Core Markup Strategy Types:

- Standard Markup – Consistent percentages across all products

- Keystone Markup – Doubling wholesale costs (100% markup)

- Tiered Markup – Different percentages by product category

- Volume-Based Markup – Lower percentages for larger orders

- Value-Based Markup – Price aligned with customer perception

Standard markup pricing is most effective when you have similar cost structures and predictable market conditions. Retailers often use keystone markup—doubling their wholesale costs—because it simplifies operations and ensures healthy margins.

What is standard markup pricing really accomplishing? It creates operational efficiency and pricing consistency that customers understand.

The addition of a standard markup to the cost of a product is known as cost-plus pricing, and it dominates B2B markets where buyers expect transparent pricing structures.

Government contractors and industrial suppliers rely on cost-plus markup because it builds trust and simplifies complex negotiations.

???? Did You Know? Luxury brands often use markup percentages exceeding 1000% because customers associate higher prices with superior quality. A handbag costing $50 to manufacture might retail for $500-800, with the premium markup justified by brand positioning and perceived exclusivity.

Markup on selling price versus markup based on cost creates completely different strategic implications.

Fashion brands often work backward from market-acceptable prices, ensuring their costs align with customer expectations rather than internal calculations.

Advanced markup strategies integrate market psychology with mathematical precision. Value-based markup aligns pricing with customer perception rather than cost structures.

Premium brands charge premium prices because customers associate higher costs with superior quality.

Choosing your markup strategy requires analyzing four key factors: product differentiation, market maturity, competitive intensity, and customer price sensitivity.

Commoditized products need aggressive markup strategies, while differentiated products support premium markup percentages.

Markup Pricing in E-commerce vs Traditional Retail

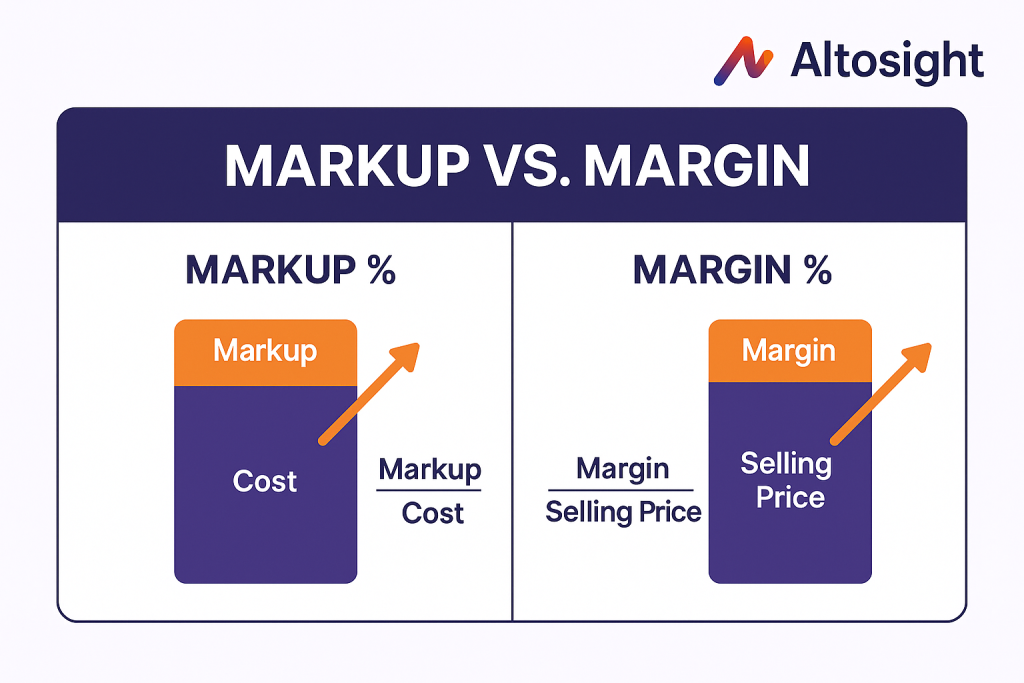

E-commerce and traditional retail require completely different markup approaches because their cost structures differ dramatically.

Online businesses face platform fees, payment processing charges, and shipping costs that brick-and-mortar stores avoid.

E-commerce Hidden Costs to Include in Markup:

- Platform fees (Amazon, eBay, Shopify: 3-15%)

- Payment processing (2.9% + $0.30 per transaction)

- Shipping and fulfillment costs

- Return processing expenses

- Customer acquisition costs

How to mark up prices in e-commerce means accounting for Amazon fees, PayPal charges, and fulfillment costs that can add 15-25% to your base product costs.

What does mark up price mean when you’re selling across multiple online channels? It means maintaining profitability while competing on price transparency.

Traditional retail markup calculations include rent, utilities, staff wages, and inventory carrying costs.

Physical stores justify higher markups through customer service, immediate availability, and shopping experiences that online retailers struggle to match.

Traditional Retail Cost Factors:

- Commercial rent and utilities

- Staff wages and benefits

- Insurance and security systems

- Visual merchandising expenses

- Inventory shrinkage (theft, damage)

Omnichannel businesses face the biggest markup challenges. Customers expect consistent pricing across online and offline channels, but cost structures vary significantly.

Successful companies create markup strategies that account for channel-specific costs while maintaining brand consistency.

Advanced Tactics: Dynamic, Psychological & Technology-Driven Markups

Technology enables markup strategies that were impossible just a few years ago. AI-driven systems analyze competitor pricing, demand patterns, and inventory levels to optimize markup percentages in real-time.

Dynamic markup systems automatically adjust pricing based on predefined rules. When inventory runs low, markups increase to maximize revenue. When competitors cut prices, systems respond instantly to maintain market position.

???? Did You Know? Amazon changes prices on over 2.5 million products daily using automated markup optimization. Their algorithms consider over 50 factors, including competitor pricing, demand velocity, inventory levels, and seasonal trends, to maximize profitability across millions of SKUs.

Psychological pricing integration requires careful coordination with markup goals.

Charm pricing ($9.99 instead of $10.00) affects markup calculations because you’re working backward from psychologically appealing price points rather than forward from costs.

Maintained markup definition becomes crucial when promotional pricing enters the picture.

Initial markup might be 50%, but maintained markup—what you actually receive after discounts and promotions—could be 35%. Smart businesses track both metrics to understand true profitability.

Key Performance Metrics to Track:

- Initial markup percentage

- Maintained markup percentage

- Gross margin dollars

- Inventory turnover rate

- Price elasticity response

Bundle pricing creates markup opportunities that individual product pricing cannot match. Customers perceive bundled products as offering a better value, allowing for higher overall markups than when component parts are sold separately.

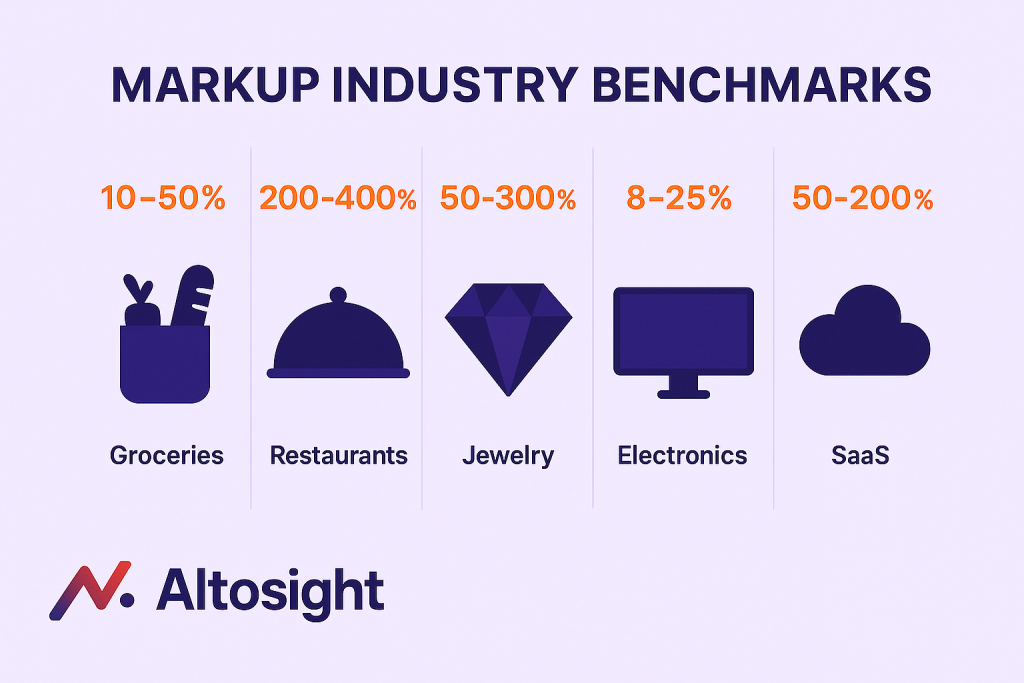

A Closer Look at Industry Benchmarks

The standard markup for fashion retailers is typically 55-62%, with luxury brands reaching 200-300%. Fast fashion operates on volume with lower markups (40-60%), while designer brands justify premium markups through exclusivity and brand positioning.

Electronics retailers operate with tighter margins—typically an 8-25% markup—because price transparency and competition limit their pricing flexibility. Accessories and cables offer higher markup opportunities (50-100%) than core electronics products.

Industry Markup Benchmarks:

- Fashion: 55–62% (luxury brands can exceed 200%)

- Electronics: as low as 8–25%, but accessories often reach 100%

- Restaurants: 200–400% on food, 500%+ on beverages

- Jewelry: typically 100–300%, but luxury pieces far more

- Software services: 150–500% depending on specialization

- Grocery: 10–50%, depending on category

Restaurants operate on 200-400% food cost markups, but labor and overhead costs mean net profits remain modest. Beverage markups often exceed 500% because customers accept premium pricing for convenience and experience.

Professional services markup varies dramatically based on specialization and market positioning. General consultants may use markups of 150-200% on their time costs, while specialized experts typically command markups of 300-500% for their unique expertise.

???? Did You Know? Movie theater popcorn has one of the highest markup percentages in retail—often exceeding 1200%. A bag of kernels costing $0.25 sells for $3-$8, but theaters rely on concession profits, as movie ticket sales barely cover licensing costs.

SaaS businesses create markup revenue models through subscription pricing that amortizes development costs across many customers. Software licensing resellers typically work with 15-40% markups because competition limits pricing flexibility.

Interactive Tools & Templates

Professional markup calculations require precision that manual methods cannot guarantee.

Our embedded markup calculator handles both cost-based and selling-price-based calculations while accounting for platform fees, taxes, and other variables that affect true profitability.

Markup & Price Calculator

Compute selling price, margin, and profit — including fees and tax.

Inputs

Results

| Component | Amount |

|---|

???? FAQ Section

What is the difference between markup and margin?

Markup is based on the cost of a product, while margin is based on the selling price. For example, a $40 item sold for $60 has a 50% markup but only a 33.3% margin.

What is a typical markup percentage?

It depends on the industry. Grocery stores may operate on 10–20%, while restaurants often use 200–400% markups. Luxury goods can exceed 500%.

How do I calculate markup quickly?

The basic formula is:

Markup % = (Selling Price – Cost) ÷ Cost × 100

Or to find selling price:

Selling Price = Cost × (1 + Markup %)

Is a higher markup always better?

Not necessarily. A higher markup can reduce sales volume, which may lower total profits. The best strategy balances markup with customer demand and competition.

What are common mistakes in markup pricing?

Ignoring hidden costs, applying the same markup across all products, and failing to track maintained markup after discounts are the most costly errors.

Optimize Your Markup Strategy With Smart Price Intelligence

You now possess complete markup pricing knowledge—from basic calculations through advanced optimization strategies. The challenge is having the right data and competitive intelligence to make informed decisions consistently.

Effective markup pricing requires constant market awareness. You need to know when competitors change their prices, which products offer the best markup opportunities, and how market dynamics affect your pricing power. Manual monitoring requires hours of effort every week, yet still misses critical changes that impact your profitability.

Professional pricing teams rely on automated intelligence systems that track competitor prices across hundreds of websites, identify markup opportunities you might miss, and alert you to market changes before they affect your bottom line. Instead of spending time gathering data, you focus on strategic decisions that drive results.

What if you could…

- Monitor competitor pricing changes automatically and receive instant alerts when market conditions shift.

- Identify products where you can safely increase markup percentages without losing competitiveness.

- Track which competitors consistently undercut your prices and adjust your markup strategy accordingly.

- Discover new market opportunities by analyzing competitor product assortments and pricing gaps.

- Receive daily intelligence reports that highlight your best markup optimization opportunities.

Altosight gives you the competitive intelligence that makes markup pricing decisions confident and profitable. Our platform continuously monitors your competitive landscape, identifies pricing opportunities, and delivers actionable insights directly to your inbox. You spend less time on data collection and more time on profitable decision-making.

Whether you're protecting minimum advertised prices across retail channels, optimizing markup percentages based on real-time competitive data, or discovering new products to add to your portfolio, professional price intelligence accelerates the results of your markup strategy.

Ready to make your markup pricing decisions with complete market confidence? Schedule a Free Demo and discover how businesses like yours use competitive intelligence to optimize their pricing strategies and protect their profit margins.